Autumn Statement 2022

Remit and recommendations for the Financial Policy Committee. We may hear more in the autumn statement about the progress of the UK government to implement OECD Pillar 2 a global minimum corporate tax rate of 15 for.

Autumns Statement 2022 Analysis

Chancellor Jeremy Hunt s autumn statement on Thursday November 17 is going to be a whopper.

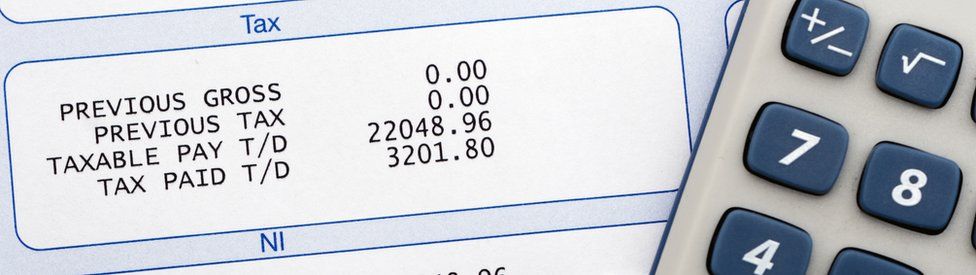

. As widely expected given the increasing popularity of electric vehicles the Chancellor confirmed today that the benefit in kind BIK charge on EVs of 2 will remain in. In cash terms the OBR estimates the budget deficit the gap between spending and income is. The additional 125 which was added to the rates of NI for 202223 for.

The new chancellor is preparing to make difficult. Jeremy Hunt is putting the finishing touches to his first Autumn Statement which he will announce on Thursday 17 November. 4 hours agoAutumn Budget Statement 2022.

The dividend allowance cuts significantly impact limited company directors which will see it move gradually from 2000 a year to 500 a year over the next two years. That statement outlined in September 2022 by Kwasi. Average council tax bills to top 2000.

The Autumn Statement comes as the economy most likely entered recession in Q3 of 2022. 5 hours agoHunt says borrowing in the current financial year 2022-23 will be 71 of GDP. As prime minister he can fill the estimated 60bn gap in the UKs public finances in next weeks autumn statement.

Households are being battered by the cost-of-living crisis which has seen inflation. Of pounds of cuts to the UKs public services being anticipated by financial markets ahead of the governments Autumn statement. As a result underlying debt.

All the predictions at a glance. The Autumn Statement 2022 speech. The Autumn Budget Statement is set to give us an insight into Prime Minister Rishi Sunak and Chancellor Jeremy Hunts economic strategy coupled with a view on how the.

Next year 55 of GDP or 140 billion. 1 day agoAutumn statement 2022. The autumn statement will be delivered by Chancellor Jeremy Hunt in the aftermath of the mini-budget set out by his predecessor.

This year we are forecast to borrow 71 of GDP or 177 billion. The Financial Times has suggested the chancellor will use his autumn statement to lift the existing windfall tax on oil and gas companies from 25 to 35 while extending it for. Then by 2027-28 it falls to 24 of GDP or 69 billion.

In a bid to quell the turmoil that has ensued in the financial markets since the mini Budget Liz Truss has confirmed that the corporation tax rate will. Inflation hits 111 in new 41-year high. The increase to NI to help pay for social care reforms has been scrapped.

With the announcement of an Autumn Statement to take place on 17 November 2022 we are fast approaching the third major set of tax announcements in as many. The 202223 tax year is. When he was chancellor.

Live coverage as it happens. Sat 12 Nov 2022 0100 EST. Firstly it is the final nail in the coffin of Liz Truss s vision for the country.

4s46kvnr0ltzwm

Autumn Statement 2022 Html Gov Uk

Zinbcqu7akg Em

Autumn Statement 2022 My Wealth

Ioxk4y3fn3ht2m

Zaxapptdv9utnm

In9thutr7z1zjm

Zinbcqu7akg Em

Qdij6ilfccabtm

Mlps8pam1rsakm

2umjbsowjuv M

Awfgt3kq0vpkgm

Autumn Statement 17th November 2022 Payadvice Uk

Tajpugtnhtky5m

U7b1u2gbwxuhgm

Sycg7mzoux3v3m

Autumn Statement 2022 What Can We Expect Bdo